Dominance: The True Driver of Marketplace Success

By Baris Guzel

A common misconception in the marketplace world is that sheer scale always equates to success. Many believe that accumulating gross merchandise volume (GMV) across numerous geographies or categories is the most reliable path to profitability and long-term value. This could lead Boards to prematurely push marketplace companies into new geographic expansions. Yet, does this truly generate enduring value?

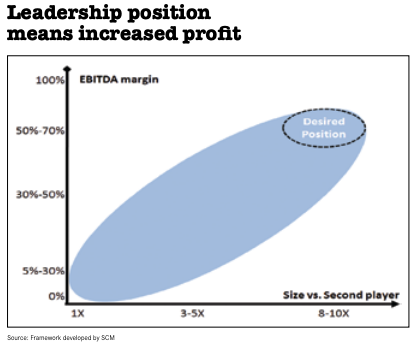

I recall a particularly insightful business school case study on Schibsted, the Norwegian media giant known for its extensive online classifieds empire. Their internal analysis of diverse portfolios, including real estate and job sites, revealed a striking pattern: profitability wasn't merely a function of being the top player in a market. It was directly correlated with the magnitude of their lead over the second-largest competitor. The greater the market share differential, the higher their margins. This underscored a crucial insight: in marketplaces, leadership isn't enough - domination is key.

Source: Schibsted Case Study- CBS Case Competition

Market dominance drives growth by creating a virtuous cycle: greater market share leads to denser networks, improving matching, reducing churn, and increasing pricing power. This boosts profits, allowing reinvestment in algorithms and supply, amplifying improvements and lowering unit costs. Dominating one market also facilitates expansion into others, creating a robust flywheel. This concept, rooted in economic principles from Adam Smith’s “The Wealth of Nations” to modern platforms, highlights how a leading player can optimally match supply and demand, minimize churn, and capture value. Spreading resources thinly, however, dilutes these benefits, leading to fragmented operations and subsidies. True market dominance compounds benefits, resulting in higher utilization, superior data, and significant entry barriers that enhance margins and equity.

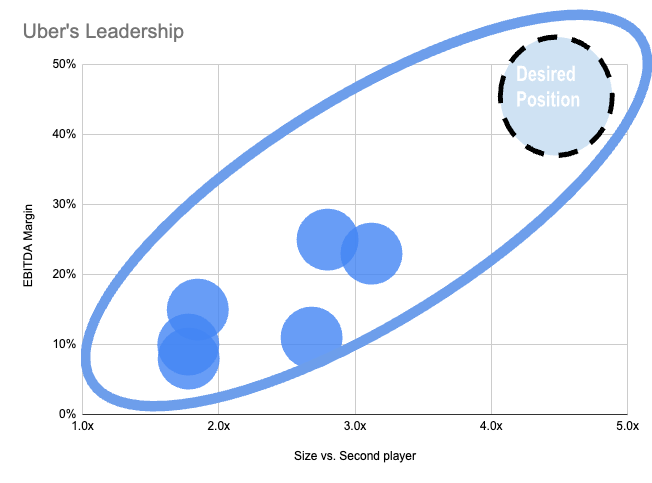

As an investor, I’ve been fortunate to partner with some of the most impressive marketplace businesses, including Xometry ($XMTR - for details), Mapillary (acquired by Meta), and Macrofab, among others. As I've observed over time, the real prize isn't sheer scale for scale's sake. It's dominance in a core market. True dominance creates network effects that are hard to replicate, drives pricing power, and ultimately unlocks higher margins. To test this, let's examine Uber in the U.S. ride-sharing market.

Market Cap tells the same tale

Uber's journey offers a clear case study: as its market share solidified in its home turf, EBITDA margins improved significantly. I've pulled historical data on U.S. market share and adjusted EBITDA margins (based on Uber and Lyft’s SEC filings and, Wall Street Research)

Interestingly, equity value, as measured by year-end market cap, appears to track EBITDA margins more closely than gross merchandise volume (GMV). The charts below illustrate this correlation, excluding the anomalous 2020 market cap surge influenced by COVID-19 and ZIRP. The correlation between EBITDA margins and market cap is notably stronger than that between GMV and market cap. This analysis, however, is based on a limited dataset and involves several assumptions.

We see that the investors didn’t award Uber for doubling GMV in 2022; they waited for margin proof:

- 2022: GMV & share up, but margins shallow, so the market cap stalled near $50 bn.

- 2023-24: Margins broke double digits, as a result market cap leapt to ~$130 bn

Clearly, public markets price sustainable profit, not just blistering growth.

TL;DR: The GMV vanity trap

If you’re building or evaluating a marketplace:

- Focus on your core: Win a key geography or vertical first: dominance there is what unlocks leverage.

- Prove unit economics: Show stable, reproducible margins at scale before chasing expansion stories.

- Beware fragmented growth: Aggregating modest share across dozens of markets can mask underlying losses.